5 loans without collateral in Ghana that you can access

Getting a loan without collateral in Ghana to scale your business should not be something that is hard to obtain. However, it is known that in Ghana the process of getting a loan is quite cumbersome especially when collateral is needed to complete the transaction.

Ghanaians usually shy away from loan opportunities when some form of collateral is involved as it poses too much risk to their livelihood, which has opened up the gateway for mobile money loans.

Another factor that stops or minimizes loan applications is the processing time it takes to acquire a loan. In most circumstances, when you really need the loan, it is best to plan ahead to apply ahead of the time you would actually need it.

If not, the processing time could even outnumber the period you urgently needed the loan for, rendering the purpose of the loan futile. This has created the avenues for mobile money loans in Ghana, which can be accessed within the shortest amount of time, with some even granting the service almost instantly.

READ ALSO: What Are the Right Channels for SMEs?

Therefore, in this article, I would introduce you to 5 loans in Ghana that can be accessed without collateral, in order to grow your business.

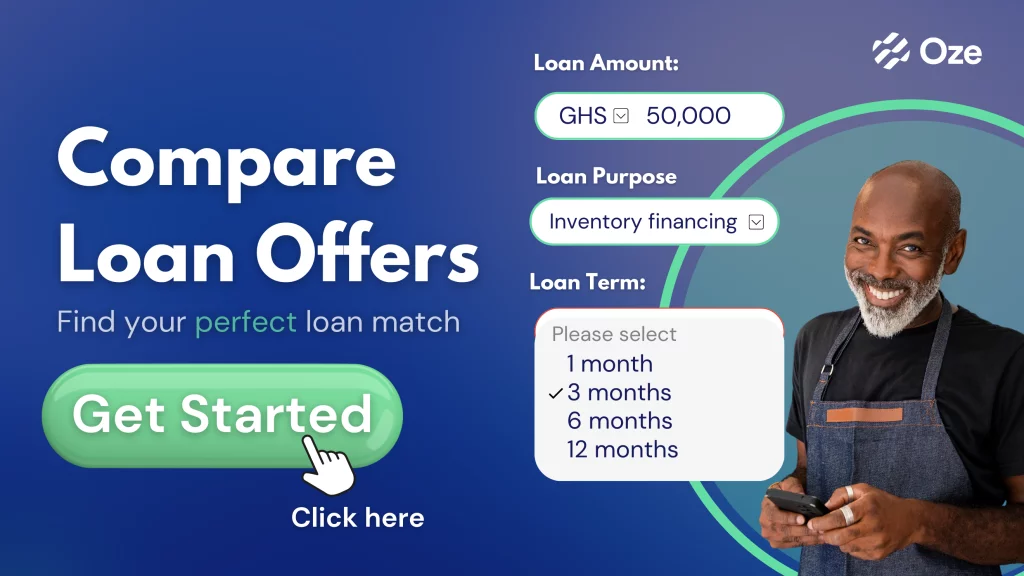

Oze SME Loan

Oze partners with financial institutions and other fintechs to offer small business loans to users who consistently use the Oze Business App and have completed the loan application and passed the Loan Prep Process. Oze offers up to 30,000 Ghana Cedis. These short loans in Ghana are given out with as little as 3% monthly interest on the amount received. The loan can be repaid in installments over a period of 12 months.

To be eligible for the loan, an applicant has to be an active Oze Business App user for at least 30 days. After 30 days, they can apply for an Oze loan directly from their Oze Business App.

MTN Qwick Loan

MTN partnered with AFB Ghana, to provide customers with MTN loans, which is accessible to users who have actively transacted in their wallet beyond 90 days. Qwickloan, is an instant way to access cash at any time for any purpose and offers up to 1,000 Ghana Cedis. The loans have a 6.9% interest rate on the amount given. The “collateral” regarding this loan is frequent use of MTN Mobile Money as well as committing to repay previous loans on time in order to have access to more loans of larger sums. To access the loan, simply;

-

Dial *170#

-

Select option 5 -financial services

-

Select option 3 – loans

-

Select option 1 to register for free or option 2 to view terms and conditions

Fido Loan

Fido Loans are provided by Fido Micro Credit (FIDO), a financial institution based in Accra. Fido Microcredit is a private money lender in Accra, that provide loans through their app, to anyone who has a valid ID and a mobile money account, with no collateral or guarantors.

For first time borrowers, they are eligible to receive a maximum of 200 Ghana Cedis to be paid back within 10 to 33 days. However, as a person keeps borrowing, they build their creditworthiness to receive larger sums at discounted interest rates. The interest rates start from 14% for 30 days for new customers and go as low as 8% for 30 days for returning customers.

Zidisha Loan

Zidisha is an online microlending community that directly connects lenders and entrepreneurs, without intermediaries. Zidisha loans are offered to anyone who has the Zidisha app, a valid ID and a good reputation based on recommendations from friends and family. Usually, entrepreneurs post their loan applications as well as their reason for taking the loan, and individuals who give loans in Ghana 2021 who are also on the app, decide if they would like to fund partially or fully of the entrepreneur’s loan amount.

Hence, Zidisha loans can be as little as $1 and as large as the amount the entrepreneur posted that they needed. There is no interest rate when borrowing from Zidisha. However, there is a service fee of 5% of the loan amount as well as an on-time membership fee of 40 Ghana Cedis.

PayLater Loans

PayLater is a platform of private money lenders in Accra, that provides the service of smart cash loans in Ghana through their app, where one receives an instant deposit of the loan after the application is submitted. Applicants just need to create an account with the app and fill in the application with their basic information, once the application is approved, it gets received in 5 minutes.

PayLater offers loans to the tune of 5 Ghana cedis for first-time users at a 5% monthly interest rate. The loan duration is between 15 to 30 days to repay.

READ ALSO: Owning your finances: Budgeting and Record-Keeping

Who has the best offer?- You decide!

In conclusion, these are 5 loans in Ghana you can access without collateral, which have different offers but are assured of delivering their proposition of offering quick mobile money loans in Ghana. If you asked for my opinion, I would recommend Oze ~ thank me later!